I asked Sriram Gollapalli, a founding member of TBD Angels and Long Angle, to share some details on TBD Angel’s tech stack and the ways in which it has helped TBD become one of the largest and most active angel networks in the US, since its inception 3 years ago. This is part of PEVCtech‘s series on investment management firms’ tech stacks.

Q: Please give us an overview of TBD Angels.

TBD Angels is an early-stage investing group, founded in early 2020, with a mission to enable our members to extract value out of the collective group through collaboration during dealflow, and engagement with our portfolio companies. We’ve assembled over 300 investors from over 30 states and 6 international countries, where many of our members are current or former operators & founders with experience battling some of the same challenges that our portfolio founders face. During our 3 years, we’ve seen about 400-500 deals and have invested in about $10MM in 75 deals across 65 companies.

Members collaborate throughout the process, but make their own decisions on which deals they want to invest in, and how much they’d like to invest. For the actual investments, we aggregate all interested members into a single SPV, resulting in a streamlined approach for our group and the portfolio companies.

Q: Can you please share your major tech needs (e.g., CRM, marketing tech, back office); the tech providers you’re currently using; and their strengths and weaknesses?

In addition to leveraging the collective knowledge of our group and ultimately using that to make better investment decisions, one of our goals in creating TBD was to fix what we saw as broken with angel group investing: Slow, legacy processes; high friction in the process; minimal investor engagement; lack of diversity.

Some of these issues can be addressed through smart application of tech. TBD Angels has been successful in marrying our experienced membership with the use of smart products to move faster and collaborate:

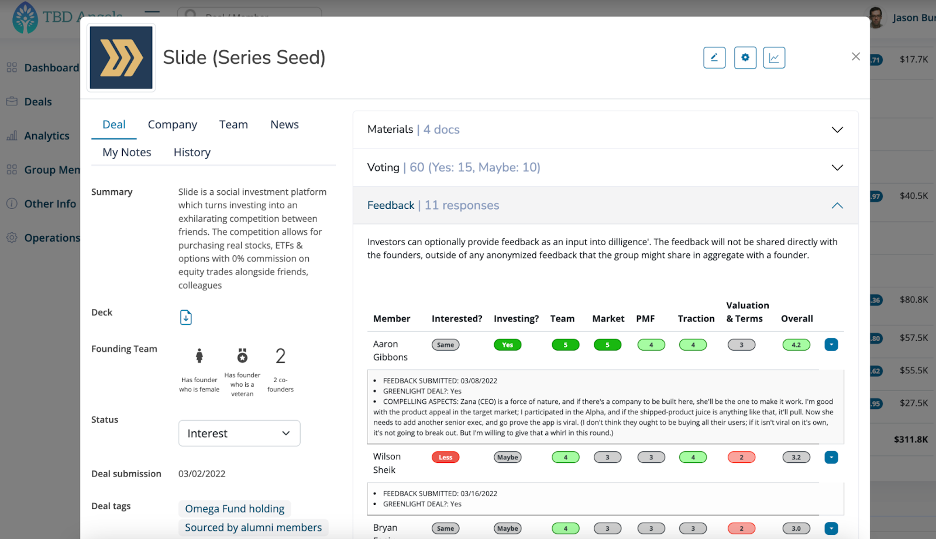

- All Stage‘s Community product is the foundation of our group’s operations and dealflow collaboration. Community is our group’s portal used for deal flow management (deal submission, data room, screening, voting, feedback, commitments, portfolio reporting). Each member of the group has an account, and we invite outside investors and founders on a deal-by-deal basis).

- Zapier provides the connective tissue between the member activity in All Stage and other communication, scheduling and workflow tools, allowing for these integrations and automation to further optimize operations.

- Formstack alongside All Stage & Zapier allows us to solicit pitch meetings dates from founders, for deal leads to request SPV creation, for members to refer new members.

- clipr transcribes and categorizes the content of our pitch meeting video recordings. Their product, integrated into All Stage, auto-categorizes meeting topics and can help our members save time by honing in on the relevant 2min portions of a 60min meeting.

- Slack is used by our members for real-time communication amongst members, both on general topics and on deal-specific topics. All Stage and Zapier combine to automatically create deal-specific slack channels and add the appropriate members based on their activity in the portal.

- Wrangle is used for some of our workflow management through their Slack integration, allowing us to have visibility into work item tickets, assign tasks, review status, etc.

- Google’s suite of tools is used for email, calendaring and document sharing. We have a large Google Group that allows members to communicate/collaborate as necessary.

- Zoom is our platform of choice for pitch meetings and internal meetings. All videos are recorded and automatically made available within the deal page on our All Stage portal.

- We make our investments on 3rd party SPV platforms like Sydecar, allowing us to roll up many investors into a single investment (our biggest deal had 55 investors), providing one line item on the cap table for the founder and a single entity for TBD to manage.

Q: A number of other angel group management tools exist, notably Gust (which we used at HBS Alumni Angels of NY) and AngelList. Why did you launch All Stage? How is it distinct? What traction has it achieved so far?

AngelList has built a powerful suite of products, which are more focused on the transactional side of the process, and in aggregating interested investors. At TBD Angels, we set out to create a collaborative process, which was also more efficient than status quo, and we found that some of the legacy tools were lacking in having sufficient functionality to support these goals, and also had limited interoperability with other tool sets.

It was important that the foundation of our tech stack be a platform with features focused on the needs of early-stage investing within a large, dynamic investment group. Further, we acknowledge that we have some unique processes and methods of operation, so a platform’s flexible configurations and interoperability & integrations with other pieces of our stack were key drivers in adopting the platform. When deciding on an investment group product, group leaders should be considering some of these higher-level aspects to ensure that it will help them meet the needs of the group, and of their individual members.

Jason Burke, one of TBD’s co-founders, started to build a solution for TBD Angels to address our requirements, and through conversations with other investment groups, began to recognize that our needs and goals of a platform were not unique to TBD. In 2022, All Stage was incorporated as a standalone business to expand platform adoption to other investment groups and to founders.

Some All Stage features critical for our mission at TBD Angels:

- Mobile & desktop compatible

- Deals

- Submission with deal drafts

- Deal screening

- Deal lifecycle management

- Data room

- Voting

- Feedback

- Commitments

- Founder questions

- Sharing with non-members (ie: founders, outside investors) to the deal

- Deal & Investor blocks

- Deal tags

- Interoperability

- Data Exports

- APIs for integrations with 3rd party systems

- Zapier integration for automation and notifications

- Integration with Showcase, All Stage’s founder-centric product, for alternate deal submissions

- Group newsletter generation

- Support for automated notification about deal-level activity

- Analytics & Reporting

- Portfolio and group activity

- Member listing and investor profile & activity

- Voting analytics

- Data room activity analytics

- User Management

- Group-level and investor-level privacy controls

- Administrator users

All Stage has helped our widely distributed group drive faster, more informed and successful investment decisions through collaboration with other members.

Q: How do you create and track the work of due diligence groups (i.e., the angels who want to assess a particular company, and share notes on them)? What technology tools have you found helpful in doing this?

As a member-run organization, our diligence process is shared across relevant people and includes…

- outreach to external subject matter experts

- inquiries to founders

- Securing company and deal-specific collateral, uploaded into the All Stage data room by the deal lead, or by the founder

- leveraging the TBD Angels network to identify people who might share insights that will help us vet companies

Members provide perspective about the deal within a dedicated Slack channel automatically created by All Stage & Zapier, and made up of those members who have expressed interest in the deal (via voting positively, following the deal, or making a commitment within All Stage).

Q: What tools do you find helpful for expediting the stages of due diligence, both institutionally and via each angel’s own due diligence process?

At TBD Angels, individual investors are empowered to perform their own diligence alongside the wider diligence happening across the group. As a community, we’re often exploring our respective networks to support our light diligence process.

We are believers in leveraging purpose-built products for the jobs to be done. We balance our use of generalist tools for items that are not investing-specific (ex: video conference, communication, Linkedin) with purpose-built products like All Stage which address the specific activities of an active angel group.

Q: Managing the subscription process for angels can be tricky. Do you have a technology solution in place? (Versatile VC uses FlowInc, in which I’m an investor.)

For deals that progress towards the commitment phase, our members can declare soft commitments to invest in All Stage. Our deal leads monitor this and determine when the aggregate interest exceeds our threshold required for an investment. We then spin up an SPV on a 3rd party platform (e.g., Sydecar) where investors will sign documents, wire funds and ultimately receive tax material.

Q: Do you offer your angels any technology tools to support portfolio construction for direct investments?

Not really.

Many of our members invest with other angel groups, and in direct investments in companies. Many of the processes and perspectives members experience at TBD Angels can be applied in investment opportunities outside our group.

Q: What are your unmet technology needs? Places in your organization where you’re seeking a solution and haven’t found an appropriate one? These may indicate room for Versatile VC to build or invest in a startup addressing that need.

As a large, distributed, 300-member group, we often struggle with identifying the appropriate subject matter experts as we evaluate opportunities. Some of the social networking platforms with rich data, like LinkedIn, fall short on helping understand which members of a group have an area of expertise, or who might be connected to relevant contacts which might help a portfolio company.

Q: A huge amount of valuable data flows through your pipes: about applying companies, companies which win investments, the angels’ investing patterns, and so on. What are you doing to capture that data and mine it? Can you share any patterns you have identified?

While we are not directly automating the use of data, our various platforms are capturing the various activities from our healthy dealflow and large membership. Some of the platforms in our stack are using this various data as inputs into their products.

Below is an example of some insights captured by All Stage revealing group sentiment across deals related to certain industries. We can use this sort of data to predict which deals might best resonate with the group.

The data behind our activity does help understand various trends, as shown in our 2022 year in review report.

Q: Do you see any room to use AI to exploit your dataset? If so, what are you doing to move that forward?

There are clear opportunities for AI and other applications of data solutions to be used in early-stage investing to deliver alpha, for effective deal discovery, and for analyzing historical data. We are looking forward to benefiting from new products from All Stage and others which apply technology to data sets to create value for investors and founders. While this has been a defining part of public market investing, we are likely to see innovations in the early-stage, private markets in the coming years.

Q: What are your membership criteria?

Our members come from referrals from existing members who submit their recommendation through a Formstack-powered submission tool which flows into Zapier and All Stage. Someone on our operations team has an introductory call with each new prospective member and provides a short history of TBD Angels and insight into how we operate. A group is only as good as its members, so we are looking for diversity across demographics, geographic, expertise, and unique connections in their network. As we grow our quality membership, the value of our community grows exponentially.

Q: I imagine you periodically have people joining not because they have cash to invest and want to lock it up in an illiquid, high-risk investment, but because they want to network with angels. How do you assess if someone is joining for the right reasons?

Each member brings something different to the group and, as a member-run organization, we like to understand what the candidate is looking to get out of being a member, and how they would like to engage within the group. While TBD Angels is an “investing group”, the investing element is just a piece of our efforts. Our members are often collaborating and networking socially outside of deal flow.

Q: Why would you reject someone?

The meeting between one of our operations team members and a prospective candidate is partly to ensure that the relationship between TBD Angels and the member can be mutually beneficial.

The question “Why are you interested in TBD Angels?” can help reveal whether someone might not be a good candidate for membership. While most prospective members are interested in seeing healthy deal flow, the best TBD Angels candidates are those who are also looking to deliver incremental value to the group, through the support of founders, pitching in on various efforts within the member-run group, networking with other members, etc. When building a community, as we have at TBD, there is a value to both quality and quantity. The people we bring into the group are ones that contribute as much value as they might receive.